Welcome to the world of financial security solutions, where Switzerland takes center stage. In the fast-paced realm of securitization, Switzerland has emerged as a formidable player with the expertise and sophistication needed to navigate the intricate webs of the global financial landscape. One key player in this arena is "Gessler Capital," a Swiss-based financial firm that is setting new standards in securitization and fund solutions.

Switzerland, known for its commitment to privacy, stability, and precision, offers an ideal environment for securitization solutions. With a well-established legal framework and a robust regulatory system, Swiss institutions provide the necessary confidence for investors seeking secure and risk-managed financial products.

Gessler Capital, with its deep-rooted Swiss heritage, stands at the forefront of advancing securitization solutions in the country. Leveraging their extensive experience and expertise, Gessler Capital has developed a range of innovative Guernsey Structured Products that offer investors unique opportunities for diversification and enhanced returns.

But Gessler Capital’s influence extends beyond its product offerings. Recognizing the importance of collaboration and resource-sharing in today’s interconnected world, Gessler Capital has actively pursued a strategy of financial network expansion. By building strategic partnerships and alliances with global institutions, they have created a network that enables the seamless execution of securitization solutions on a global scale.

As the demand for secure and efficient financial solutions continues to grow, Switzerland remains a trusted destination for securitization. With Gessler Capital leading the way in innovative offerings and financial network expansion, the future of securitization solutions in Switzerland looks brighter than ever. Stay tuned as we dive deeper into the realm of securitization and explore the myriad ways it is reshaping the landscape of financial security.

Securitization Solutions

Securitization Solutions Switzerland is at the forefront of developing innovative financial strategies to address the growing complexities of the global market. With a focus on Guernsey structured products and expanding their financial network, they are paving the way for a new era of secure investments.

Gessler Capital, a Swiss-based financial firm, is leading the charge in offering a diverse range of securitization and fund solutions. They understand the importance of providing investors with tailored options that align with their specific needs and risk preferences. By harnessing the power of securitization, Gessler Capital enables investors to unlock the potential of diverse asset classes while managing risk effectively.

Switzerland’s robust regulatory framework and commitment to transparency make it an ideal hub for securitization solutions. The country’s strict adherence to international standards and its sophisticated financial infrastructure provide a solid foundation for investors seeking security and stability. As a result, Switzerland has become a preferred destination for those looking to optimize their investment strategies while minimizing risk.

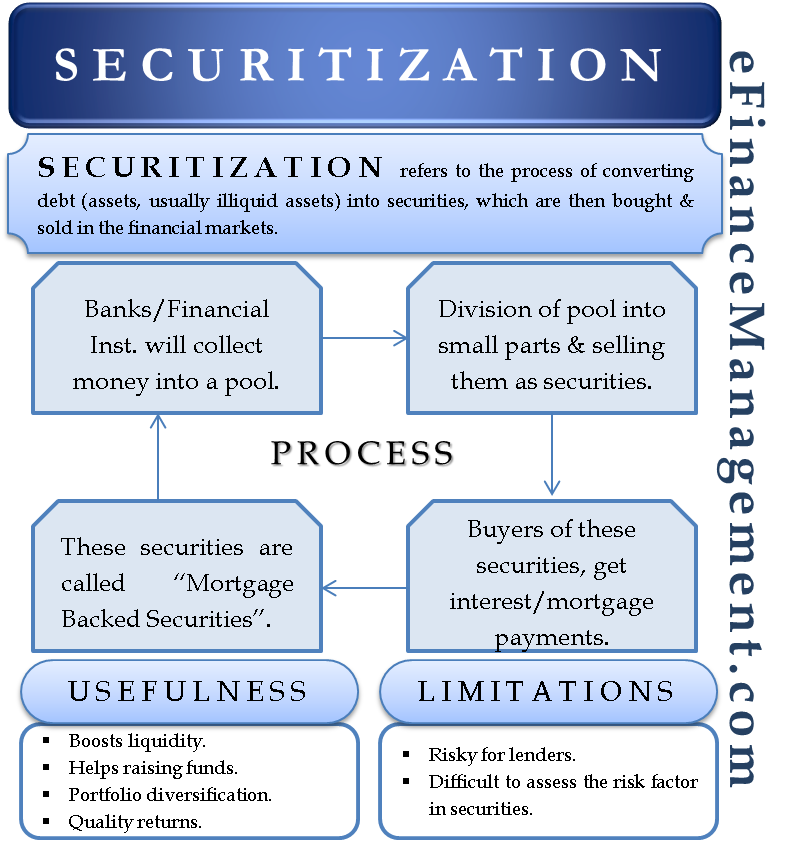

Gessler Capital’s securitization solutions offer a multitude of benefits for investors. These solutions allow for the efficient transfer of risk, enabling investors to diversify their portfolios and mitigate potential losses. Furthermore, securitization provides increased liquidity, allowing investors to access their capital when needed. With Gessler Capital’s expertise and experience in the field, investors can confidently navigate the complexities of securitized products and unlock a world of investment opportunities.

In conclusion, Securitization Solutions Switzerland, spearheaded by Gessler Capital, is revolutionizing the way investors approach their portfolios. With a focus on Guernsey structured products and expanding their financial network, they are catering to the unique needs of investors while ensuring security and transparency. By offering securitization solutions that unlock the potential of diverse asset classes, they are paving the way for a more secure and prosperous future in the world of finance.

Security Token Offerings (STO)

Guernsey Structured Products

Guernsey, known for its robust financial industry, offers a wide range of structured products that attract both local and international investors. These products provide a secure and efficient way to diversify investment portfolios while minimizing risks. With its strong regulatory framework and investor-friendly environment, Guernsey has become a preferred jurisdiction for structuring innovative financial instruments.

One of the key advantages of Guernsey structured products is their flexibility. Investors can tailor these products to meet their specific investment objectives and risk appetite. Whether it’s capital protection, income generation, or capital growth, Guernsey’s structured products can be designed to align with diverse investment strategies. This flexibility, combined with the expertise of financial professionals in Guernsey, enables investors to access tailored solutions that match their unique investment needs.

Financial institutions in Guernsey have also played a vital role in the growth and development of structured products. Their commitment to maintaining high standards of governance and transparency has earned Guernsey a reputation as a reliable and trustworthy financial hub. Through continuous collaboration with industry experts, Guernsey has created a conducive ecosystem for the growth of structured products, attracting both established players and newcomers alike.

As the demand for structured products continues to increase globally, Guernsey is poised to capitalize on this trend. Its strong network of financial institutions, coupled with a forward-thinking regulatory framework, provides a solid foundation for the expansion of structured product offerings. With its ability to adapt to evolving market needs, Guernsey is well-positioned to remain a hub for innovation in the securitization industry.

In the next section, we will explore the financial network expansion facilitated by Guernsey Structured Products and the role of Switzerland’s very own Gessler Capital in this arena. Stay tuned for more exciting insights into the world of securitization solutions Switzerland has to offer.

Financial Network Expansion

Securitization Solutions Switzerland is leading the way in financial network expansion. With their innovative approach and expertise in Guernsey structured products, they have established themselves as a prominent player in the industry. The strategic partnerships they have formed have allowed them to broaden their reach and offer a comprehensive range of solutions to their clients.

Gessler Capital, a Swiss-based financial firm, has been at the forefront of this expansion. Their commitment to excellence and dedication to meeting client needs has enabled them to forge valuable relationships with key players in the financial sector. Through these partnerships, they have been able to tap into new markets and provide even more tailored solutions to their clients.

The comprehensive financial network developed by Securitization Solutions Switzerland is a testament to their unwavering focus on meeting the evolving needs of the industry. By constantly seeking out new opportunities and expanding their horizons, they have positioned themselves as a reliable and innovative partner for both institutional and individual investors.

In conclusion, the financial network expansion achieved by Securitization Solutions Switzerland highlights their commitment to providing top-notch solutions to their clients. Through strategic partnerships and a dedication to staying ahead of the curve, they have established themselves as a leader in the field of securitization and fund solutions. With Guernsey structured products as a cornerstone of their offerings, they continue to unlock security for their clients in Switzerland and beyond.