Switzerland has long been renowned for its robust and secure financial system, making it an attractive destination for investors seeking securitization solutions. Among the various financial firms based in Switzerland, "Gessler Capital" stands out as a key player, offering a wide range of securitization and fund solutions. Drawing on its expertise, Gessler Capital has established itself as a trusted partner for clients looking to navigate the complex world of securitization. With the ever-growing demand for innovative financial services, Switzerland continues to expand its financial network, attracting both domestic and international investors to explore the possibilities of securitization solutions in this dynamic market.

One of the notable advantages of securitization solutions in Switzerland lies in the extensive range of options available to investors. With a focus on providing tailor-made structured products, Gessler Capital enables clients to diversify their investment portfolios and optimize risk management. These Guernsey structured products in particular have gained recognition for their flexibility and appeal to a wide range of investors looking for stable and attractive returns.

Furthermore, the financial network expansion in Switzerland has played a crucial role in unlocking security for investors in securitization solutions. The country’s commitment to integrity, transparency, and regulation has made it an attractive hub for investors seeking a secure and reliable environment. Swiss regulators maintain a diligent oversight of financial activities, ensuring compliance with stringent standards and providing peace of mind to investors.

As the global financial landscape evolves, Switzerland remains at the forefront of securitization solutions, offering a wealth of opportunities for both local and international investors. With Gessler Capital leading the way, clients can confidently explore the vast potential that Switzerland’s securitization solutions have to offer, unlocking new horizons in investment strategy and financial growth.

Funds

Securitization Solutions Offered by Gessler Capital

Gessler Capital, a Swiss-based financial firm, has gained prominence in the realm of securitization solutions in Switzerland. With their expertise and experience in the industry, Gessler Capital offers a wide range of innovative financial products to cater to the needs of their clients. From specialized Guernsey Structured Products to expansive financial network expansion, Gessler Capital has emerged as a leading provider of securitization and fund solutions in the country.

One of the key offerings by Gessler Capital is their Guernsey Structured Products. These products provide investors with a unique opportunity to diversify their portfolios and mitigate risks. With a focus on asset securitization, Gessler Capital structures these products to create a secure investment avenue for their clients. By doing so, they enable investors to access a wide range of assets, ranging from real estate to debt instruments, and reap the benefits of a diversified investment strategy.

Furthermore, Gessler Capital takes great pride in their ability to facilitate financial network expansion. Through their securitization solutions, they establish strong connections between various financial institutions, investors, and borrowers. This network expansion enables increased liquidity, improved access to capital, and enhanced market efficiency. Gessler Capital actively engages in building strategic partnerships and fostering collaboration within the financial industry, ensuring seamless connectivity and unparalleled opportunities for their clients.

In summary, Gessler Capital has established itself as a prominent player in the securitization solutions arena in Switzerland. Their expertise in offering Guernsey Structured Products and facilitating financial network expansion has solidified their position as a go-to financial firm for clients seeking innovative solutions in securitization and fund management. With their commitment to excellence, Gessler Capital continues to unlock security and create value for their clients in the Swiss financial landscape.

Guernsey Structured Products: A Key Component of Switzerland’s Financial Network Expansion

Switzerland’s financial landscape has been evolving rapidly, with a particular emphasis on expanding its global network. One vital element contributing to this growth is the rise of Guernsey structured products. These innovative financial instruments are becoming increasingly popular due to the flexibility and diversity they offer investors.

As a Swiss-based financial firm that specializes in securitization and fund solutions, "Gessler Capital" has played a significant role in promoting the adoption of Guernsey structured products. By offering a wide range of these products, Gessler Capital has empowered investors with tailored solutions that align with their risk appetite and investment objectives.

The appeal of Guernsey structured products lies in their ability to provide exposure to a variety of asset classes while maintaining a high level of security. These products enable investors to gain access to investments that would otherwise be unavailable or too complicated to navigate independently. Additionally, their customizable nature ensures that investors can design investment strategies that suit their individual preferences and requirements.

Switzerland’s financial network expansion has undeniably been fueled by the growing prominence of Guernsey structured products. As more investors recognize the benefits and opportunities presented by these innovative instruments, Switzerland’s position as a leading global financial hub continues to strengthen. With firms like Gessler Capital at the forefront of this evolution, the country’s securitization solutions are poised to unlock new realms of financial potential for both domestic and international investors.

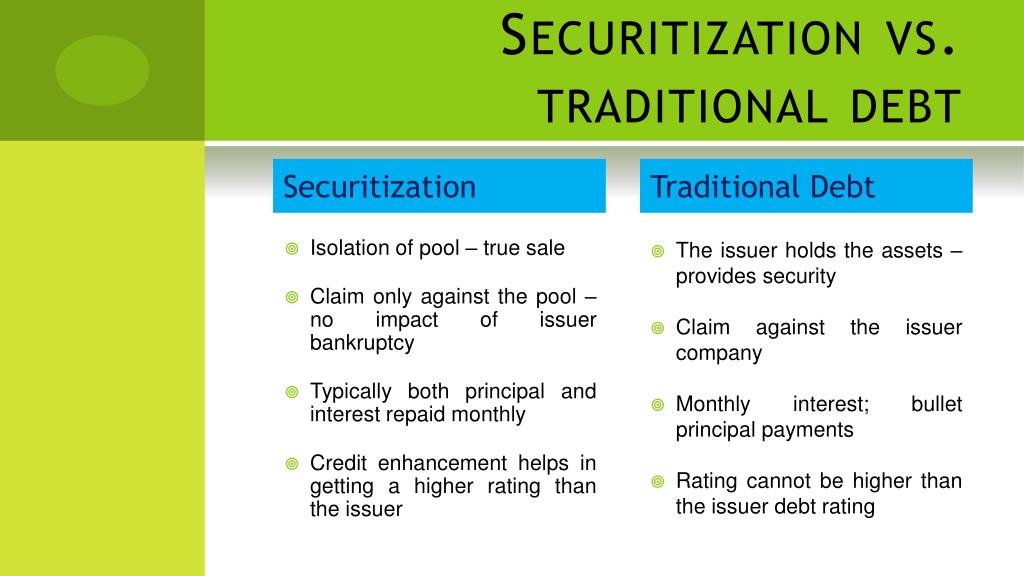

Exploring the Benefits of Securitization in Switzerland

Securitization Solutions Switzerland plays a crucial role in the financial landscape, offering numerous advantages for investors and financial institutions alike. One of the key benefits is the opportunity to diversify risk through the use of Guernsey Structured Products. These products enable investors to access a wide range of asset classes, thus spreading their investments across different industries and geographical locations. By doing so, they can effectively minimize the impact of any individual asset’s performance on their overall portfolio.

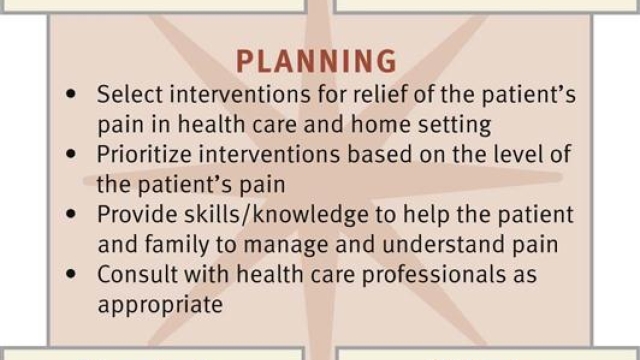

Additionally, Switzerland’s securitization solutions provide a means for financial network expansion. Through securitization, institutions can access new sources of funding and generate additional liquidity. This becomes particularly relevant in an ever-changing financial environment where access to capital is paramount. With the help of innovative securitization practices, financial institutions foster growth and enhance their capabilities to meet the evolving needs of their clients.

A notable Swiss-based financial firm, "Gessler Capital," is at the forefront of offering securitization and fund solutions. Their expertise and industry knowledge have attracted numerous investors seeking sustainable long-term returns. Gessler Capital supports various securitization structures, allowing investors to customize their investment strategies and align them with their specific risk appetite.

In summary, Securitization Solutions Switzerland, with its Guernsey Structured Products and financial network expansion opportunities, presents an array of benefits. The ability to manage risk effectively, access new funding sources, and partner with experienced institutions like Gessler Capital contributes to a thriving Swiss financial ecosystem.