Welcome to the intriguing world of microcaptives, a revolution in the field of captive insurance. These captivating entities have been gaining attention due to their unique characteristics and potential for both financial and tax advantages. A microcaptive is essentially a small insurance company that is created and controlled by a business, allowing that company to insure its own risks.

One of the key factors that sets microcaptives apart is the utilization of the IRS 831(b) tax code. This provision allows certain small insurance companies to be exempt from tax on their underwriting income, making it an attractive option for businesses seeking to manage risk and optimize their financial strategies. By leveraging this tax advantage, microcaptives have become an effective tool for businesses to customize their insurance coverage and mitigate their exposure to various risks.

With the increasing popularity of microcaptives, it is important to navigate the complexities of both the captive insurance industry and the associated tax regulations. In this article, we will delve deeper into the world of microcaptives and unravel the enigma surrounding their benefits, challenges, and potential impacts. Join us as we journey into the microcaptive revolution and discover the opportunities it presents for businesses of all sizes.

Understanding Microcaptive Insurance

In the realm of insurance, a notable trend has emerged known as microcaptive insurance. This innovative approach allows small to medium-sized businesses to create their own captive insurance companies, tailored to their unique needs. By harnessing the benefits of captive insurance, these companies can achieve greater control over their risk management strategies and potentially enjoy financial advantages.

At the heart of microcaptive insurance is the IRS 831(b) tax code, which provides certain tax incentives to qualifying captives. Under this code, if a captive generates $2.3 million or less in premium revenue annually and meets other criteria, it can elect to be taxed only on its investment income. This appealing tax treatment has sparked the growth of microcaptive vehicles as a viable alternative for smaller businesses seeking to manage their risks and control costs.

One of the key advantages of microcaptive insurance is the opportunity for a business to customize its coverage to precisely match its unique risk profile. By setting up their own captive insurance company, businesses gain the ability to tailor policies and coverage limits to their specific needs, which traditional insurance options may struggle to accommodate. This level of customization can lead to more comprehensive protection and potentially reduce insurance expenses.

It is important to note, however, that while microcaptive insurance offers potential benefits, it may not be suitable for every business. The IRS has been actively scrutinizing captive insurance arrangements in recent years to combat any abusive practices. It is crucial for businesses considering microcaptive insurance to ensure compliance with all relevant IRS regulations and engage experts proficient in navigating these complexities.

Overall, microcaptive insurance represents an intriguing option for businesses looking to enhance their risk management strategies. By delving into the intricacies of this alternative insurance approach, companies may discover opportunities for greater control, cost savings, and tailored coverage that can support their long-term growth and stability.

The Benefits and Risks of Microcaptive Insurance

Microcaptive insurance has emerged as a revolutionary strategy for businesses seeking to manage their risks effectively. By forming small captive insurance companies, also known as microcaptives, businesses can gain several benefits while also facing certain risks.

One significant benefit of microcaptive insurance is the potential for cost savings. As these captives are owned and controlled by the insured businesses themselves, they can design customized insurance plans that align perfectly with their specific risk profile. This allows businesses to avoid unnecessary coverage and premiums, resulting in potential cost reductions. Moreover, any profits generated by the microcaptive may be subject to tax advantages under the IRS 831(b) tax code, further enhancing the financial benefits for eligible businesses.

Another advantage of microcaptive insurance is enhanced risk management. Through better control and understanding of their risks, businesses can tailor insurance solutions to address their unique needs. The flexibility of microcaptives enables businesses to cover risks that are not adequately addressed by traditional insurance markets. This approach allows for greater risk retention and can lead to improved claim management and better overall risk mitigation strategies.

However, it is essential to acknowledge the risks associated with microcaptive insurance. One major risk is the potential lack of diversification. Unlike traditional insurance policies that spread risk across a wide range of insured parties, microcaptives often focus on risks specific to one business or a closely related group of businesses. This concentration of risk can magnify the impact of any losses incurred, potentially affecting the financial stability of the microcaptive.

Additionally, the IRS scrutinizes microcaptives closely due to the potential for abuse of the tax benefits provided under the 831(b) tax code. In recent years, the IRS has increased its focus on microcaptive transactions and implemented stricter regulations and reporting requirements. This means that businesses considering microcaptive insurance must ensure compliance with all IRS guidelines to avoid potential penalties or the disqualification of their captive insurance arrangements.

Get The Best Price

In conclusion, microcaptive insurance offers businesses the opportunity to tailor insurance coverage, potentially leading to cost savings and improved risk management. However, businesses must be mindful of the risks involved, including a lack of diversification and increased IRS scrutiny. By carefully assessing their risk profile and complying with applicable regulations, businesses can navigate the microcaptive revolution and make the most of this innovative insurance strategy.

Navigating the IRS 831(b) Tax Code

When it comes to understanding the IRS 831(b) tax code, navigating through the complexities can be a daunting task. The code, which is specific to captive insurance arrangements, requires careful attention to detail to ensure compliance and avoid any potential pitfalls.

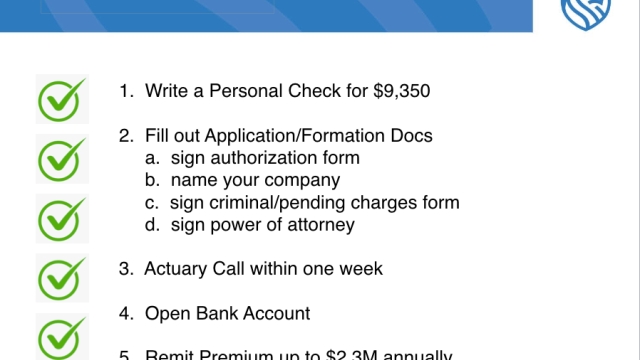

At its core, a microcaptive is a small insurance company formed by a closely-held business primarily for the purpose of insuring the risks of the business itself or businesses within the same controlled group. Under the IRS 831(b) tax code, a qualifying microcaptive can elect to be taxed only on its investment income, rather than its premiums received.

However, it is important to note that the IRS has implemented strict guidelines and requirements for a captive to qualify for this favorable tax treatment. In order to meet the criteria, the captive must have written premiums that do not exceed $2.3 million annually and must also meet certain diversification requirements.

Failure to adhere to these guidelines can result in adverse tax consequences, including disqualification from the 831(b) election and potential tax assessments. Therefore, it is crucial for business owners considering or already utilizing a microcaptive to seek expert advice to ensure compliance with the IRS tax code and maximize the benefits of this unique insurance arrangement.

In conclusion, understanding and navigating the IRS 831(b) tax code is vital for businesses engaging in microcaptive insurance arrangements. Seeking professional guidance and carefully adhering to the specific requirements set forth by the IRS is essential to make the most of this revolutionary approach to captive insurance.