When it comes to protecting our vehicles, one key aspect that cannot be ignored is car insurance. Whether you consider yourself a seasoned motorist or a new driver on the road, understanding how car insurance works and the different coverage options available to you is essential. We often find ourselves bombarded with advertisements for homeowners insurance, car insurance, and auto insurance, leaving us wondering about the nuances and secrets hidden within these policies. In this article, we will delve into the world of car insurance, uncovering the intricacies and providing you with the knowledge necessary to navigate this often confusing but necessary aspect of owning a vehicle. So buckle up and get ready to rev up your understanding of car insurance!

Understanding Homeowners Insurance

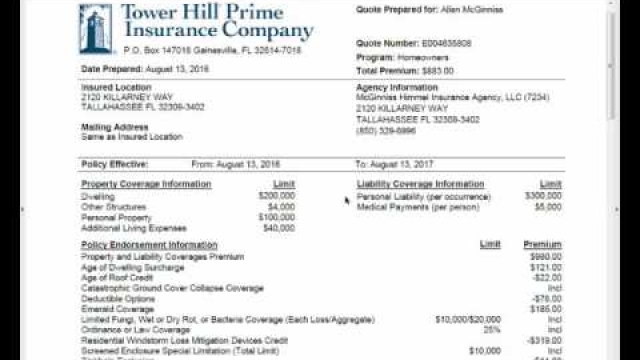

Homeownership comes with many responsibilities, one of which is protecting one of your most valuable assets. That’s where homeowners insurance comes in. Homeowners insurance is a vital coverage that provides financial protection against damage or loss to your home and personal belongings. It offers peace of mind knowing that you have a safety net in case of unforeseen events.

The primary purpose of homeowners insurance is to cover the cost of repairing or rebuilding your home if it gets damaged due to covered perils, such as fire, theft, vandalism, or natural disasters. It also helps to compensate for any loss or damage to your personal belongings, like furniture, appliances, or electronics.

Additionally, homeowners insurance provides liability protection. This means that if someone gets injured on your property and holds you responsible, your insurance policy may cover legal fees and medical expenses. It’s a crucial safeguard that can help protect you from potential financial ruin in case of an unfortunate accident.

Keep in mind that homeowners insurance policies can vary in terms of coverage limits and deductibles. It’s essential to understand your policy thoroughly, including what is covered and what is not. Taking the time to review your policy, and potentially making adjustments to fit your needs, is a worthwhile effort to ensure you have adequate protection for your home and personal belongings.

Understanding the ins and outs of homeowners insurance is crucial for every homeowner. It provides financial security and peace of mind, allowing you to focus on enjoying your home without worrying about unexpected expenses.

Decoding Car Insurance

Car insurance, also known as auto insurance, is a crucial financial protection that covers vehicle owners from potential financial loss in case of accidents, theft, or damage to their cars. Understanding the fundamentals of car insurance is essential to ensure you have the right coverage that meets your needs.

One aspect of car insurance that is often overlooked is its close relationship with homeowners insurance. While the two types of insurance may seem unrelated, they are often bundled together to provide comprehensive coverage for both your home and your vehicle. This bundling option allows policyholders to save money by purchasing both types of insurance from the same provider.

When it comes to car insurance, there are several key terms and components that you should be familiar with. One of the most essential is liability coverage, which protects you from legal responsibility in the event of an accident that causes injury or property damage to others. This coverage is typically divided into bodily injury liability, which covers medical expenses for injured parties, and property damage liability, which covers the repair or replacement costs of any damaged property.

Another important aspect of car insurance is collision coverage. This type of coverage applies to the costs of repairing or replacing your own vehicle if it is damaged in an accident, regardless of who was at fault. Collision coverage is especially important for newer cars with higher values, as the cost of repairs or replacement can be substantial.

Comprehensive coverage is yet another crucial component of car insurance. This coverage protects your vehicle from non-collision incidents such as theft, vandalism, or damage from natural disasters. It provides financial assistance in repairing or replacing your vehicle, ensuring that you are not left burdened with the full cost in these unfortunate situations.

By familiarizing yourself with the intricacies of car insurance, you can make informed decisions about the coverage you need. Taking the time to understand the various types of coverage, their costs, and the benefits they offer will not only help you save money but also provide you with peace of mind on the road.

Navigating Auto Insurance

Car insurance can sometimes be a perplexing world to navigate. Understanding the intricacies of auto insurance can help ensure that you get the right coverage for your needs. Here are a few key points to keep in mind when exploring car insurance options:

Know your coverage options: There are several types of car insurance coverage available. Liability insurance is typically mandatory and covers damages to other vehicles or property in case of an accident that is deemed your fault. Collision coverage, on the other hand, helps pay for damages to your own vehicle in the event of a collision. Comprehensive coverage provides protection against non-accident-related incidents, such as theft or damage caused by natural disasters. Understanding these different coverage options can help you select the right policy that suits your needs.

Consider your deductible: The deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Typically, the higher your deductible, the lower your premium will be. It’s essential to strike a balance between a deductible that you can afford to pay comfortably and a premium that fits within your budget.

Auto Insurance Grand Rapids MiShop around for the best rates: Car insurance premiums can vary significantly between providers. It’s worth taking the time to compare quotes from different insurance companies to ensure you’re getting the best deal possible. Consider factors such as coverage, reputation, and customer reviews to make an informed decision.

Navigating the world of auto insurance doesn’t have to be overwhelming. By understanding your coverage options, considering your deductible, and shopping around for the best rates, you can make informed choices that protect both yourself and your vehicle.