Captive insurance, a term that carries enormous potential for businesses of all sizes, is rapidly gaining traction as a powerful risk management tool. Designed to offer companies greater control over their insurance programs, captive insurance allows businesses to operate their own insurance company, providing coverage tailored to their specific needs. One key aspect of captive insurance that has garnered attention is the IRS tax code Section 831(b), which outlines the regulations for small insurance companies known as microcaptives. Understanding and harnessing the benefits of captive insurance under this tax code can open up a world of opportunities for businesses to optimize their risk management strategies and financial outcomes. In this article, we will delve into the intricacies of captive insurance, explore the nuances of the IRS 831(b) tax code, and unveil the potential this unique risk management approach holds for businesses looking to unlock their full potential. So, let’s embark on this journey together and discover the power of captive insurance.

What is Captive Insurance?

Captive insurance refers to a unique form of self-insurance where a business creates its own insurance company to cover its risks. Rather than relying on traditional insurance providers, the business establishes a captive insurance company that is wholly owned and controlled by the organization itself.

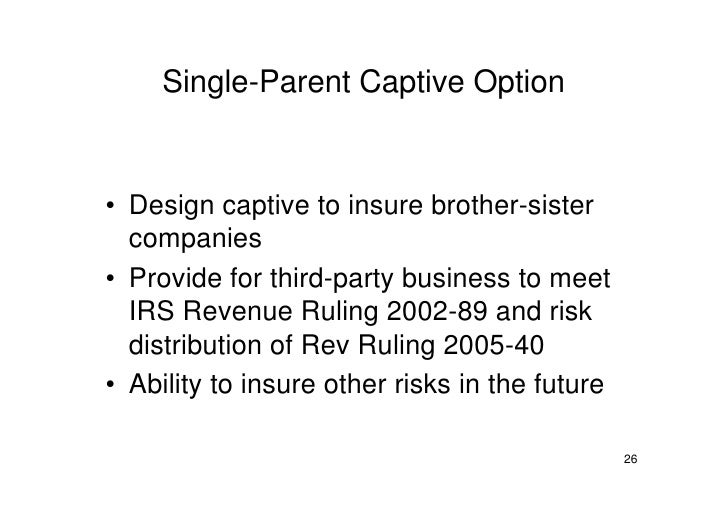

This alternative risk management strategy allows businesses to have greater control over their insurance coverage and claims processes. By forming a captive insurance company, businesses can tailor their policies to match their specific needs and risk profiles, providing them with more customized and cost-effective insurance solutions.

One specific provision within the tax code, known as IRS 831(b), has further incentivized the establishment of captive insurance companies, particularly microcaptives. This provision allows qualifying captive insurance companies to benefit from certain tax advantages, such as the exclusion of premiums received from taxation, granting businesses additional financial incentives to explore captive insurance as a viable risk management tool.

Overall, captive insurance represents a powerful tool for businesses to mitigate risks effectively while taking advantage of potential tax benefits. By unlocking the potential of captive insurance, businesses can secure more tailored and flexible insurance coverage, ultimately enhancing their risk management strategies.

Microcaptive

Understanding the IRS 831(b) Tax Code

The IRS 831(b) tax code is a crucial aspect when it comes to leveraging the power of captive insurance. This tax code specifically pertains to microcaptives, which are smaller captive insurance companies that qualify for certain tax advantages. By comprehending the IRS 831(b) tax code, businesses can unlock significant benefits and optimize their captive insurance structures.

At its core, the IRS 831(b) tax code allows eligible businesses to qualify for special tax treatment regarding their microcaptive insurance companies. With this code, such businesses can elect to receive specific tax advantages, such as taxation on underwriting profits at a lower rate. This provision aims to encourage businesses to utilize captive insurance by creating a favorable taxation environment.

For a business to qualify under the IRS 831(b) tax code, certain criteria must be met. The annual premium limit for captive insurance companies operating under this code is $2.3 million, making it attractive for small and medium-sized enterprises (SMEs). However, it is important to adhere to the strict guidelines set by the IRS to ensure compliance with the tax code.

Understanding and effectively utilizing the IRS 831(b) tax code is key for businesses looking to unlock the potential of captive insurance. By meeting the necessary requirements and taking advantage of the tax benefits provided, businesses can strategically manage risk, create financial efficiencies, and ultimately enhance their overall success.

The Power of Microcaptives

When it comes to navigating the complex world of insurance, businesses often find themselves caught in a web of high premiums and limited coverage options. However, there is a powerful solution that stands out among the rest—microcaptives. These innovative insurance structures, authorized under the IRS 831(b) tax code, are transforming the way small and mid-sized businesses protect their assets.

Captive insurance, in general, involves creating a separate insurance company to provide coverage exclusively to the parent organization. Microcaptives take this concept a step further by focusing on smaller businesses and offering unique advantages tailored to their specific needs. By setting up a microcaptive, businesses can gain control over their insurance program, customize coverage, and potentially enjoy significant tax benefits.

One of the key benefits of a microcaptive is the ability to tailor insurance coverage to the unique risks faced by the parent company. Unlike traditional insurance policies, where coverage may be limited or costly due to industry-specific risks, microcaptives offer flexibility and customization. By crafting policies that specifically address their unique vulnerabilities, businesses can ensure comprehensive coverage that aligns precisely with their risk profile.

Moreover, microcaptives offer potential tax advantages that can significantly contribute to a company’s financial well-being. Under the IRS 831(b) tax code, a qualifying microcaptive with premiums not exceeding $2.3 million per year can elect to be taxed only on its investment income, rather than its underwriting profit. This can result in substantial tax savings, allowing businesses to reinvest those funds back into their operations or pursue strategic growth initiatives.

In conclusion, microcaptives have emerged as a game-changer for businesses seeking control, customization, and financial benefits in their insurance programs. By harnessing the power of these innovative insurance structures, businesses can mitigate risk more effectively, optimize coverage to their specific needs, and unlock their full potential for growth and success.