Imagine that hot weather takes thirteen months to get the place rented out again. The good news? Perhaps may get get $250 more rent this free time. The bad updates? Thirteen months of expenses, and expenses of re-renting likely to likely total to about $60,000. Implies you have $210,000 invested now, and the cash flow of $15,000 represents simply bit over 7% cash-on-cash return.

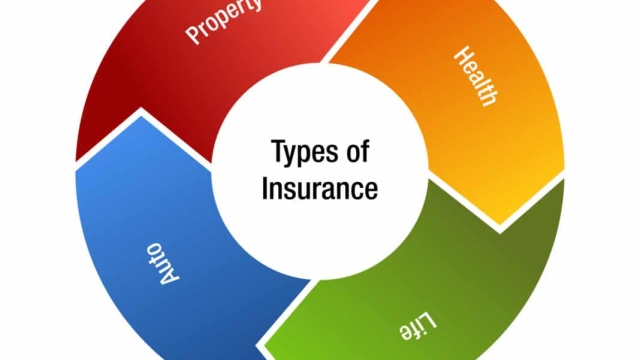

This is the reason it’s advisable to ask a broker who focuses primarily on truck insurance to quote your rrnsurance policy. Why is it best? They represent a number of different insurance corporations.

School districts have renters insurance for all student activities already. You can expect to see these kind of events at the local high school through out the sunny periods.

commercial property insurance California

This may be like your group’s business only, a lot of policies, even event policies, could be based upon income. How many certificates do you’ll? You may not know this either. Obviously you need one for the property user. After all, the only reason that you simply are commercial property insurance meeting with the insurance agent/broker is simply because they questioned one. You may decide to weigh up this for your second.

What you have been looking for in this way are things that impact occupancy, risk, and money flow. The landlord and the tenant is actually affected differently and will set their own priorities to your lease. The house or property manager will be the person that must be topping the lease in all respects.

If you’ve got doubt, remember your neighbours! The A.M.Best Company gives your insurance underwriter a financial report card. The State of California protects you with the C.I.G.A. fund. And a truck insurance broker avoid problems. If you are ever in doubt, give us a call. We’ll call the Department of Insurance to look at your company’s status and A nice.M. Best rating. We promise not perform games with your business in order to create our lifestyle.

The cost to perform phase 1 for the borrower is about $1,800. If concerns are noted each morning report, the borrower will be expected to acquire a Phase 2 which is around $10,000. This can put a difficult “damper” along at the momentum on the loan.