Ensuring Financial Safety: Unraveling the Importance of Workers’ Compensation Insurance

When it comes to operating a business, the safety and well-being of employees should always be a top priority. In the fast-paced and demanding world of California’s commercial sector, ensuring financial safety through proper insurance coverage is crucial. One such insurance policy that holds significant importance is workers’ compensation insurance. This type of insurance not only protects employees in the event of work-related injuries or illnesses but also safeguards the financial stability and reputation of businesses. From restaurants to commercial establishments and even transportation companies, workers’ compensation insurance plays a vital role in creating a secure and stable work environment. In this article, we will delve into the intricacies of workers’ compensation insurance, looking specifically at its benefits and the regulations surrounding it in California. Additionally, we will also touch upon other essential insurance policies such as commercial insurance and commercial auto insurance that businesses in California should consider for comprehensive coverage. So, fasten your seatbelts and get ready as we unravel the importance of workers’ compensation insurance and the various insurance options available to California businesses.

The Importance of Workers’ Compensation Insurance

Workers’ Compensation Insurance plays a crucial role in ensuring financial safety for both employers and employees. This type of insurance provides coverage for workplace injuries and illnesses, offering various benefits to individuals and businesses.

First and foremost, Workers’ Compensation Insurance provides medical benefits to employees who suffer injuries or illnesses related to their job. From minor injuries to more severe ones, this coverage ensures that employees receive the necessary medical treatment without having to bear the financial burden themselves. Whether it’s a slip and fall accident in a restaurant or an injury caused by machinery in a factory, this insurance can alleviate the stress of medical expenses and help individuals recover more quickly.

Additionally, Workers’ Compensation Insurance offers wage replacement benefits. In the unfortunate event that an employee is unable to work due to a work-related injury or illness, this coverage provides a percentage of the lost wages during the recovery period. This not only helps employees maintain their financial stability during tough times but also provides peace of mind knowing that their income is protected.

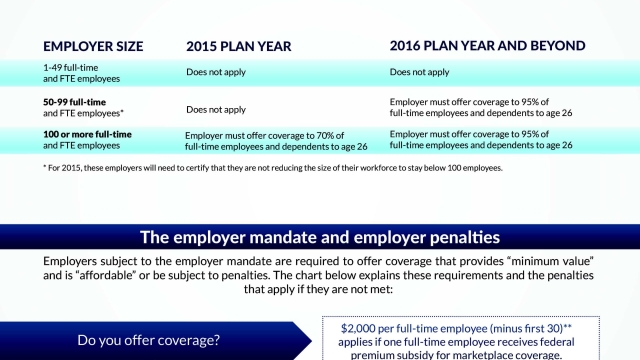

For employers, having Workers’ Compensation Insurance is not only a legal requirement in many jurisdictions but also a means to protect their business from potential lawsuits. By providing coverage for workplace injuries, this insurance helps shield employers from costly litigation and legal expenses that could arise from accidents or negligence claims. Moreover, it demonstrates a commitment to the well-being of employees, leading to a more positive work environment and improved employee morale.

In conclusion, Workers’ Compensation Insurance is vital for maintaining financial security in the workplace. It provides medical benefits and wage replacement to employees, while also safeguarding businesses from potential legal repercussions. By understanding the importance of this insurance, both employers and employees can work together to create safer and more secure work environments.

Guide to Commercial Insurance in California

When it comes to protecting your business in California, having the right commercial insurance is essential. Whether you own a restaurant, a retail store, or any other type of business, safeguarding your assets and employees should be a top priority. In this guide, we will explore the importance of commercial insurance and provide you with valuable insights to help you navigate the insurance landscape in California effectively.

- Commercial Insurance for the Restaurant Industry in California

Running a restaurant in California can be a rewarding venture, but it also comes with its fair share of risks. From kitchen accidents to liability claims, having the appropriate insurance coverage is crucial. Restaurant insurance in California offers comprehensive protection tailored to the unique needs of the foodservice industry. It typically covers general liability, property damage, workers’ compensation, and commercial auto insurance. By investing in a comprehensive policy, you can ensure that your restaurant is well-protected against unforeseen circumstances.

- Securing Your Business with Commercial Auto Insurance in California

If your business involves operating vehicles, such as a delivery service or a transportation company, commercial auto insurance is a must-have. California law mandates that all vehicles used for commercial purposes must be covered by commercial auto insurance. This coverage goes beyond personal auto insurance and provides additional protection for your business in the event of accidents, property damage, or injury to others. It is essential to review your coverage options carefully and select a policy that suits your specific business needs.

- Navigating the World of Commercial Insurance in California

Understanding the complexities of commercial insurance can be challenging, especially with the varying regulations and requirements in California. That is why seeking guidance from insurance professionals is highly recommended. They can help you assess your risks, evaluate your insurance needs, and find the best policy to safeguard your business. By working closely with an experienced insurance agent, you can ensure that your commercial insurance coverage aligns with California’s laws and regulations, providing you with peace of mind and financial protection.

Restaurant insurance California

Remember, obtaining commercial insurance in California is not only a legal obligation but also a crucial step in protecting your business. Whether you require restaurant insurance or commercial auto insurance, taking the time to research and understand your coverage options will go a long way in ensuring the financial safety of your business.

Restaurant Insurance: A Comprehensive Guide

In order to ensure the financial safety of your restaurant business, it is crucial to have the right insurance coverage in place. Restaurant insurance provides comprehensive protection against potential risks and liabilities that are unique to the food service industry. By understanding the different types of restaurant insurance available, you can safeguard your business and focus on delivering exceptional dining experiences to your customers.

General liability insurance is a fundamental component of restaurant insurance. This coverage protects your business from claims and lawsuits arising from accidents or injuries that occur on your premises. Whether it’s a slip and fall incident or a customer claiming food poisoning, general liability insurance provides the necessary financial support to handle legal expenses and potential settlements.

Another important type of insurance to consider is property insurance. Running a restaurant involves significant investments in equipment, furniture, and supplies. Property insurance not only covers damages to the building itself, but also protects your valuable assets in case of fire, theft, or natural disasters. With this coverage, you can quickly recover and minimize any disruptions to your operations.

In addition to general liability and property insurance, restaurant owners should also consider commercial auto insurance if their business involves delivery services. Commercial auto insurance provides coverage for any vehicles used in the course of business, whether it’s for catering events or food deliveries. Protecting your vehicles and drivers against accidents and any potential liability claims is essential for a smooth and secure business operation.

By understanding the importance of restaurant insurance and having the right coverage in place, you can ensure financial safety for your business. With the diverse range of risks and liabilities that exist in the food service industry, investing in comprehensive insurance coverage is a proactive measure that can save you from potential financial hardships in the future. Paired with prudent risk management practices, restaurant insurance is an invaluable asset that allows you to focus on what matters most – providing excellent food and service to your valued customers.