Commercial insurance is an essential aspect of protecting your business in today’s unpredictable world. From California restaurants to commercial vehicles, having the right coverage is crucial for safeguarding your financial stability. Navigating the world of commercial insurance can often feel overwhelming, with complicated terms and fine print that can leave even the savviest business owners scratching their heads. That’s why we’re here to help you decode the secrets of commercial insurance and provide you with a comprehensive guide tailored to California businesses.

If you own a restaurant in California, you know that it takes passion, dedication, and hard work to create a thriving culinary establishment. However, along with the daily challenges of running a restaurant, there are also potential risks and liabilities that need to be addressed. From accidents in the kitchen to slips and falls in the dining area, unforeseen events can have a significant impact on your business. That’s where restaurant insurance comes into play, offering coverage options that can protect you against property damage, liability claims, and even food spoilage. In this guide, we’ll break down the key aspects of restaurant insurance in California and help you navigate the policy options to ensure your restaurant is properly protected.

When it comes to running a business, having reliable transportation is often vital for smooth operations. As a California business owner, if you utilize commercial vehicles such as trucks or vans, you’ll want to invest in commercial auto insurance. However, understanding the ins and outs of commercial auto insurance can be perplexing without proper guidance. In our comprehensive guide tailored specifically for California businesses, we’ll demystify commercial auto insurance and provide you with essential information on coverage options. Whether it’s liability protection, comprehensive coverage, or coverage for hired or non-owned vehicles, our guide will equip you with the knowledge you need to make informed decisions about your commercial auto insurance needs.

Stay tuned as we delve deeper into the intricacies of commercial insurance in California, uncovering the secrets that will empower you to make the best choices for your business. With our guidance, you’ll gain the confidence you need to navigate the often complex world of insurance, allowing you to protect your California-based business and focus on what really matters – its success and growth.

Understanding Commercial Insurance in California

Commercial insurance plays a crucial role in protecting businesses from unexpected financial losses. In California, having the right commercial insurance coverage is essential for businesses to thrive in this dynamic state. Whether you own a restaurant or operate a fleet of vehicles, understanding the nuances of commercial insurance is of utmost importance.

When it comes to commercial insurance in California, there are several key factors to consider. One such consideration is restaurant insurance. Restaurants face unique risks and challenges, ranging from food spoilage to customer injuries. Having a comprehensive restaurant insurance policy tailored to the specific needs of your business can provide the peace of mind you need to focus on delivering exceptional dining experiences.

In addition to restaurant insurance, California businesses that rely on vehicles for their operations should also prioritize commercial auto insurance. With countless cars and trucks traversing California’s busy roads, accidents are bound to happen. Commercial auto insurance provides the necessary coverage for property damage, bodily injury, and legal expenses that may arise from auto accidents involving your business vehicles.

In conclusion, commercial insurance is a vital safeguard for businesses in California. Whether you run a restaurant or operate a fleet of vehicles, understanding the intricacies of commercial insurance can help you make informed decisions and protect your business from the unexpected. By investing in the right coverage, you can navigate the dynamic business landscape of California with confidence and assurance.

A Comprehensive Guide to Restaurant Insurance in California

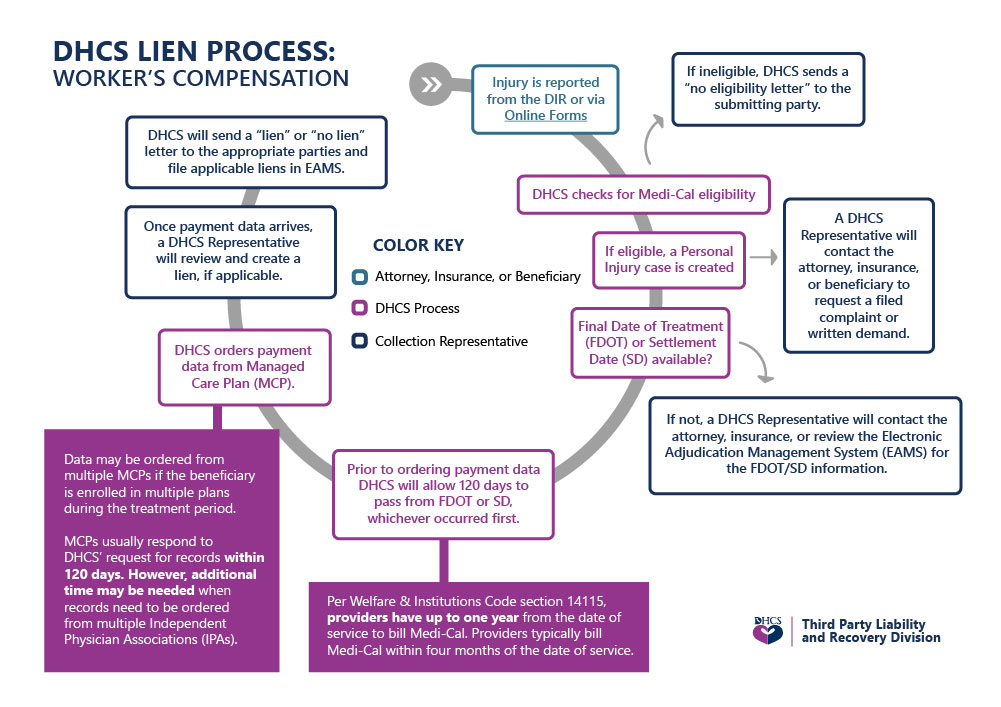

Workers Compensation Insurance in California

Owning and operating a restaurant in California comes with its fair share of risks and challenges. One way to protect your investment and mitigate potential financial losses is by having the right restaurant insurance coverage in place. Understanding the ins and outs of restaurant insurance in California is crucial for ensuring the long-term success and stability of your business.

When it comes to restaurant insurance, California has specific laws and regulations that must be followed. It is important to work with a reputable insurance provider who understands the unique needs of the restaurant industry in California. They can help you navigate the complexities of insurance coverage and ensure that you are adequately protected.

One key aspect of restaurant insurance in California is liability coverage. This protects you in the event of accidents or injuries that occur on your property. It can also provide coverage in the event of foodborne illnesses or incidents resulting from the consumption of your food. Liability insurance is essential for restaurants, as it can help cover legal fees, medical expenses, and potential damages.

In addition to liability coverage, restaurant owners in California should also consider property insurance. This type of coverage protects your restaurant building, equipment, and inventory in the event of a fire, theft, or other covered perils. Having property insurance can provide peace of mind knowing that your physical assets are safeguarded against unexpected events.

Understanding the intricacies of commercial insurance for restaurants in California is vital for every restaurant owner. By partnering with a knowledgeable insurance provider and making sure you have the right coverage in place, you can protect your business and focus on what you do best – providing excellent food and service to your customers.

Navigating Commercial Auto Insurance in California

When it comes to commercial auto insurance in California, it is crucial for businesses to adequately protect their vehicles and drivers. California is known for its busy roads and high traffic, making the need for comprehensive coverage even more important.

One key aspect to consider is the type of vehicles covered by commercial auto insurance. Whether your business operates delivery vans, trucks, or any other type of vehicle for business purposes, it’s essential to ensure that they are appropriately insured. This will provide financial protection in case of accidents, theft, or damage.

In addition to ensuring proper coverage for your vehicles, it’s important to take into account the specific requirements set by California state regulations. From minimum liability coverage to additional optional coverages, understanding and complying with these regulations is crucial to avoid penalties and ensure adequate protection for your business.

Moreover, navigating the commercial auto insurance landscape in California can be complex and overwhelming. Working with an experienced insurance provider who understands the specific needs of businesses in California can be extremely beneficial. They can guide you through the process, help you choose the right coverage options, and ensure that you are fully protected against potential risks.

By carefully considering the type of vehicles covered, complying with state regulations, and seeking guidance from professionals, businesses can successfully navigate commercial auto insurance in California. Prioritizing comprehensive coverage will not only give you peace of mind but also safeguard your business from potential financial loss in the event of unexpected incidents on the road.